SEC Drops Cases Amid Growing Pressure, Paving the Way for More Pending ETFs

Date Written: March 5 2025 Written By: James HaverfordA Change In Leadership

Gary Gensler served as the 33rd Chair of the Securities and Exchange Commission (SEC) until his final day in the role on January 20, 2025. The SEC, a U.S. government agency, oversees securities markets to protect investors from fraud and ensure fair, efficient trading environments. To achieve this, the agency enforces rules and regulations, aiming to hold all market participants accountable and impose consistent penalties on those who violate the law.

During Gensler’s tenure, the SEC gained a reputation for its aggressive stance toward the digital asset community. Reports of fines and lawsuits targeting the crypto sector became commonplace. In 2023 alone, the agency initiated 46 enforcement actions against crypto-related entities, imposing $4.9 billion in fines and penalties. However, the SEC was also criticized for failing to provide clear or coherent guidance on crypto regulations, despite repeated requests from the industry.

In contrast, the incoming Trump administration campaigned on a promise to swiftly establish regulatory clarity for the crypto market, fostering a fair and equitable environment for participants. Following his election, President Trump announced the creation of a new Crypto and AI agency, to be led by David Sacks, tasked with delivering on this commitment.

Abounded cases continues to rise

Immediately following Gary Gensler’s departure from the SEC, we’ve witnessed a fast shift in the agency’s approach to crypto enforcement. The SEC has already dropped or paused actions against high profile Cryto figures and exchanges which were still underway, signaling a plummet in the regulatory pressure against the industry present over the last few years. One of the most notable cases involved Coinbase, a leading U.S.-based crypto exchange. Filed in 2023, the lawsuit against Coinbase was officially dropped on February 27, 2025, according to a recent announcement.

The agency has also paused its lawsuit against Binance, and Kraken two of the most popular names in the space. These developments have unfolded within just a month of Gensler’s exit, at a pace we haven’t seen before. Justin Sun, another prominent figure in the crypto world is just another one who’s experienced the same fate. It raises alerts, this decision came shortly after Sun reportedly invested $75 million in the World Liberty Financial crypto project, which has ties to the current administration’s family. Coincidence or influence? That’s a question many in the crypto finance space are asking.

The trend hasn’t slowed

Cameron Winklevoss, co-founder of the Gemini exchange, tweeted that the SEC has dropped its case against his platform as well. In less than two months, lawsuits targeting some of the biggest names in the U.S. crypto industry—Coinbase, Binance, Kraken, Gemini, and more. This is particularly striking in as the country the SEC operates under has stated they are still working on developing the regulation.

The SEC’s abrupt change in direction is as unsettling as it is remarkable. The agency’s recent moves could be seen as running counter to its core mission of protecting investors and maintaining market integrity. Crypto traders and blockchain enthusiasts and investors left in the dark in regards to how they can operate within US laws.

The Crypto Industry Is Starting To Fight Back

Coinbase has taken matters into its own hands. The exchange recently filed a Freedom of Information Act (FOIA) request to pry open the SEC’s records on these investigations. For a crypto and finance audience, this move underscores a growing push for transparency in an industry often at odds with regulators. As the dust settles, market participants will be watching closely to see whether this wave of dismissals marks a turning point—or simply a brief reprieve—in the SEC’s stance on digital assets.

Crypto ETF Applications Are On The Rise

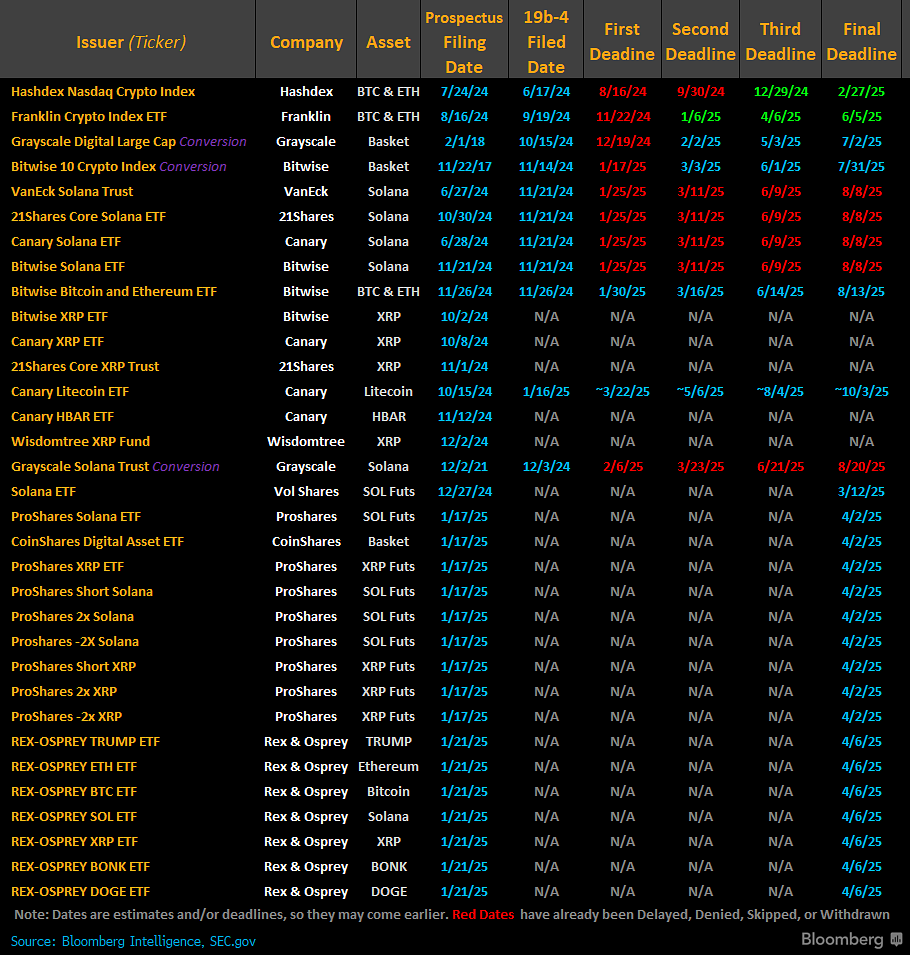

On the day following Gary Gensler’s exit from the SEC. Eric Balchunas, a prominent ETF analyst on Twitter, tweeted “33 crypto ETFs now currently filed with SEC, the list doubled since Gensler left the building on Friday.” What’s most notable about his statement is that it only addresses the applications post Gensler’s, not the other’s which have already been submitted.

The path a proposed ETF must go through before its approved for trading varies on a Varity of different factors. The large majority of ETF’s related to crypto have been rejected, and notably slow at even getting addressed by government agencies. Which have in the past routinely waited until the last day it was legally required by them to take action to render a decision.

In February 2024 the first Crypto related ETF was approved for trading. Which at the time of this article was barely a year ago. It was the Ishares Bitcoin Trust (IBIT), released by one of the biggest names in traditional Finance Blackrock. The IBIT ETF has been one of the most successful ETF’s launched in history, bringing in around 50 billion dollars in just under one year of trading.

The Road ahead

The crypto Industry continues to remain unpredictable, leaving everyone hanging on the edge of their seats. Whether it be the large number of cases the SEC has abandoned, or the large inflows of cash the first crypto ETF drew in. With other countries also indicating instruct in allowing trading in digital assets. This industry has shattered the traditional norms of finance and how our Government operates in the financial industry.

Will ETFs and the possibility of large sums of money actually benefit networks that promote decentralization? Or will the U.S. government’s attempts to regulate protocols unbound by lines drawn on maps prevail? Only time will tell. What’s particularly interesting—beyond the sheer number of applications submitted—is the businesses behind them. It’s no longer just tech startups and venture capitalists pushing for digital assets. The long list of ETF applications now comes from traditional finance companies—the same companies that once characterized the industry as a playground for money laundering, fraud, and other illicit purposes. Companies with billions under management, such as BlackRock, VanEck, Fidelity, and ProShares, are now signaling that they or their clients want exposure to digital assets. Two industries that once strived to disassociate from each other are now on a path toward entanglement. The traditional strategies of value investing and long-term holding are clashing with an industry moving faster and more unpredictably than most have ever witnessed. Per usual follow us, as we report on breaking developments of a space moving at the speed of Usain Bolt.